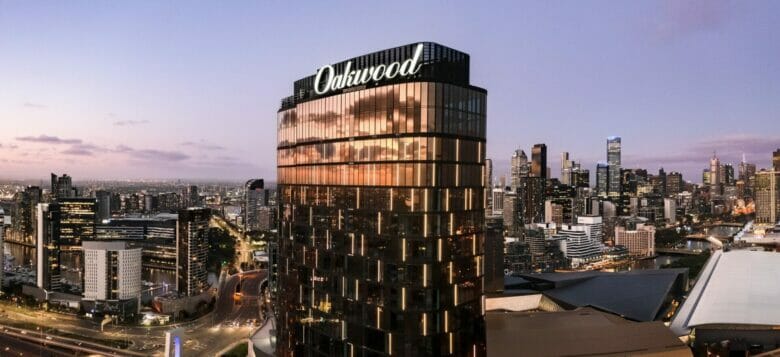

The Ascott will soon operate the newly opened Oakwood Premier Melbourne tower. (Source: The Ascott)

Singapore’s The Ascott Ltd is buying serviced residence provider Oakwood Worldwide from Mapletree Investments for an undisclosed amount in a move that would boost its management portfolio by 11 percent with the addition of 81 accommodations globally, the firm announced on Monday.

The deal would add Oakwood’s 15,000 units in 51 operational properties and 30 assets under development across Asia Pacific, Africa, Europe, Middle East and the United States to the venue roster of CapitaLand’s rental residential and hospitality division.

“This acquisition of Oakwood is part of Ascott’s roadmap to playing a bigger role in the lodging market,” said Kevin Goh, CapitaLand Investment’s chief executive officer for lodging. “We intend to build on the strong reputation and heritage of the Oakwood brand, especially in markets across Southeast Asia, North Asia and North America.”

The deal between the two Temasek-backed property giants comes around five years after Singapore-based Mapletree took over the global operations of Oakwood with Mapletree having more recently shifted the focus of its rental residential business to student accommodation.

160,000 Units by 2023

Once the deal is completed in the third quarter, Ascott estimates that the 8,500 operational units in the portfolio will generate fee income at around the same rate as other properties in its portfolio, where every 10,000 established residences generate an average of S$20 million in fee-related earnings annually.

Ascott chief executive officer Kevin Goh

The acquisition will boost Ascott’s global portfolio to over 150,000 units in 900 properties from 135,000 keys previously, bringing CapitaLand closer to its previously stated target of 160,000 units by 2023.

Geographically, Oakwood’s properties in Japan and South Korea are its biggest earners and are expected to account for 38 percent of fee-related income from the acquisition. Next on the list is Southeast Asia which is expected to contribute 30 percent of the fee income, with another 20 percent coming from China, four percent from Australia and New Zealand, and the rest sourced from locations in the Middle East, Africa and the US.

The Mapletree unit’s flagship properties are the 123-unit Oakwood Premier Tokyo in the Japanese capital’s Chiyoda City area and the 281-unit Oakwood Premier Coex Center Seoul in South Korea.

Ascott will also be adding to its management portfolio the 40-storey Oakwood Premier Melbourne tower which opened in Australia last December with 132 hotel rooms and 260 serviced apartments.

The acquisition will expand Ascott’s geographic footprint to new markets like the city of Cheongju in South Korea’s North Chungcheong province, Zhangjiakou and Qingdao in northern China, Washington DC in the US and Dhaka in Bangladesh.

On top of the operating assets, the 30 properties under development will provide 6,500 new units, which includes 14 assets in Southeast Asia and seven locations in China.

“Ascott’s acquisition of Oakwood brings about an immediate boost to our units under management and franchise contracts,” Goh said. “The Oakwood portfolio will accelerate the growth of our asset-light business, with added recurring fee income streams, expanded lodging offerings and increased customer base.”

52 percent owned by Temasek, Ascott’s parent firm CapitaLand booked $55 million in fee-related income in its lodging management business in the first quarter, up 31 percent from S$42 million the year prior. The group’s revenue per average room also jumped 34 percent to S$71 per unit in January-March, compared to S$53 per key in the same period last year.

The average occupancy in CapitaLand’s lodging portfolio also rose to 57 percent in the period from January through March from 48 percent in the previous quarter.

Student Housing in Focus

Wholly owned by Singapore state investment firm Temasek, Mapletree bought the Oakwood portfolio for an undisclosed sum in February 2017 roughly three years after the two established a $4 billion joint venture.

The 2014 deal gave the Singaporean firm a 49 percent stake in Oakwood’s operations in Asia and allowed the lodging operator to put its brand on nine Mapletree properties. With the pandemic having since dented the outlook for the type of business travel which underpinned Oakwood’s business, Mapletree has begun exploring other approaches to rental residential.

“While Mapletree will remain in the lodging sector, it has decided to be more focused on the student accommodation sector as it has already built a sizable portfolio,” a Mapletree spokesman said.

In March, the Singaporean firm was reported to be working with DBS, HSBC, OCBC and UBS to market a potential initial public offering of a student housing REIT to raise around $1 billion. Mapletree owns 57 student accommodation assets with over 24,000 beds across 38 cities in Canada, the UK and the US as of end-March.

CapitaLand has also looked for opportunities in student housing as Ascott has been scaling up its serviced residence business. As part of a string of lodging acquisitions over the past five years Ascott agreed in February to establish a $150 million development venture with Saudi investor Riyad Capital to build student housing projects in the US.

In June 2021 an Ascott-managed private fund invested by the Qatar Investment Authority agreed to invest S$210 million (then $156 million) to acquire the LiveLyfHere Gambetta Paris co-living property in France and the Somerset Metropolitan West Hanoi serviced apartment complex in Vietnam.

In 2018 Ascott purchased a 70 percent stake in Indonesian hotel operator Tauzia Hotel Management for $26 million with the acquisition coming a year after it picked up Aussie lodging operator Quest Apartment Hotels and American corporate housing provider Synergy Global Housing.

Leave a Reply