It may take some time for Shanghai to get back to normal (Getty Images)

Shanghai’s office market continued to struggle in the last quarter of 2022, as the mainland financial hub was battered by COVID-19 chaos and sluggish leasing activity, but the market is poised to bounce back this year amid a broader economic recovery, new research reports from global brokerages suggest.

Net take-up of grade A offices in China’s commercial capital totalled just 94,851 square meters (1 million square feet) in the fourth quarter, according to JLL’s latest quarterly property review for the city – a plunge of more than 74 percent from the same quarter of 2021, when 371,200 square metres of space was absorbed.

The year 2022 saw a total of 523,900 square metres of net absorption, down more than 65 percent from the previous year’s total of 1.5 million square metres. Notably, annual net absorption in decentralized areas of Shanghai was 30 times greater than in the central business district, reaching 507,271 square metres compared to 16,628 square metres in the CBD.

Shanghai’s virus outbreak earlier in the year, which led to months of lockdowns, prompted tenants to put off leasing decisions and in some cases, relocate and terminate their leases. As tenants took a more conservative approach to their space needs, landlords were forced to be more flexible in rent negotiations.

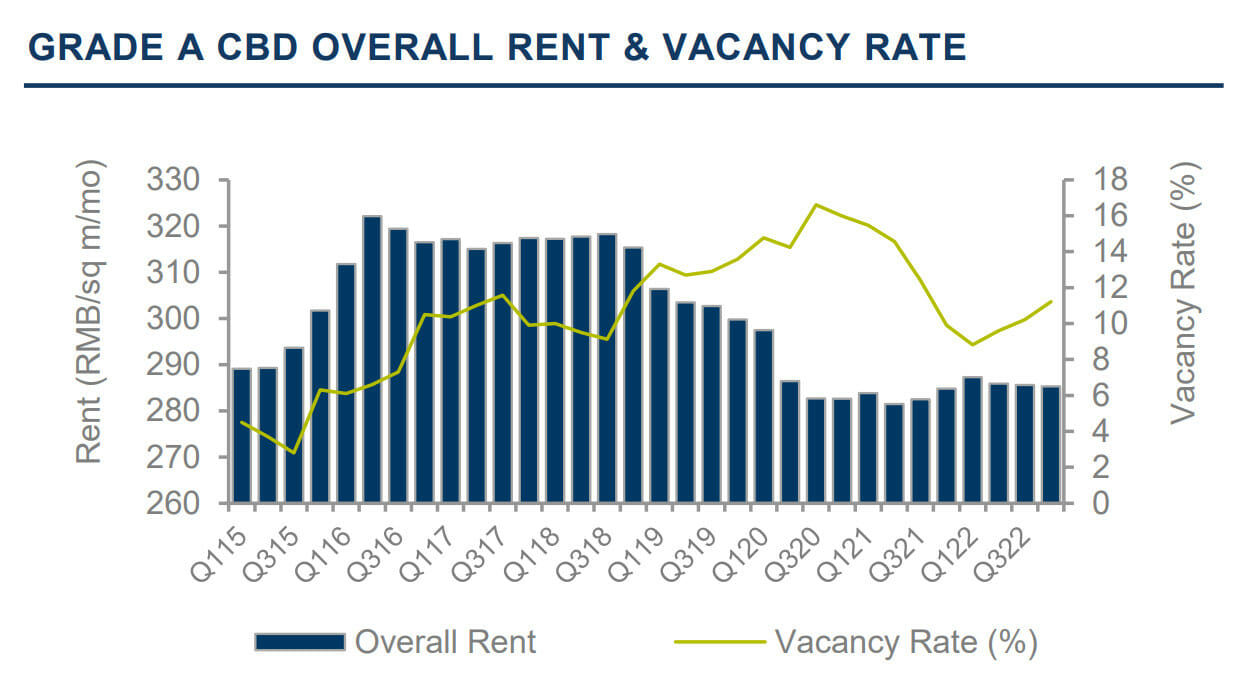

This trend continued in the fourth quarter, with CBD rents falling 0.9 percent quarter-on-quarter, according to JLL. CBD rents remained flat in year-over-year terms, as the first quarter of 2022 saw strong rental growth, followed by declines later in the year.

Decentralized rents eased 1.3 percent quarter-on-quarter and 1.6 percent year-over-year due to slow leasing and lease terminations by small- and medium-sized companies, though active submarkets proved resilient, such as Xuhui Bund and Qiantan.

Rising vacancy

Vacancy rates also highlighted the divergence between Shanghai’s CBD and decentralized market, with new supply pushing CBD vacancy to 10.2 percent at year-end, up 1.1 percentage points compared to the previous quarter and up 2.3 percentage points year-over-year.

Anny Zhang, managing director for JLL East China and head of office leasing advisory for JLL China

By contrast, the decentralized market benefitted from headquarters demand and recent project completions in popular areas, which led to strong take-up and vacancy tightening 0.5 percentage points year-over-year to 24.5 percent by the end of 2022, according to JLL.

In its own Shanghai office market report, Cushman & Wakefield cited three new high-quality office projects that hit the market during the quarter, adding 142,440 square metres of supply, including Hopson Development’s MOHO in Jing’an district, Laifung Holdings’ Skyline Tower near the Shanghai Train Station in Jing’an, and Dream Voice (Canxing Building) in the West Bund area of Xuhui district.

The brokerage found that multinationals drove more than 50 percent of leasing deals by area, with flexible office giant WeWork signing the biggest lease, a 28,000 square metre expansion at International Media Port in the West Bund area.

Gucci, Chery Jaguar Land Rover Automotive, and mobile gaming firm Paper Games also inked significant office leases during the quarter. Companies in the professional services and TMT (technology, media, and telecom) sectors accounted for 48 percent of leasing activity, followed by the manufacturing and finance industries at 12.8 percent and 11.6 percent, respectively, the brokerage added.

The city’s average monthly grade A rent fell slightly from the previous quarter to RMB 247.5 ($35.8) per square metre, while the average rent in core submarkets stabilized at RMB 285.3 per square metre, according to Cushman & Wakefield.

Brighter outlook

A silver lining during the fourth quarter was commercial property investment volume, which jumped 36.8 percent year-over-year even though the annual total for 2022 dropped 22.8 percent compared to 2021, JLL found. Policies to support the real estate industry kicked in during the quarter and helped boost deal volume to RMB 26.4 billion, representing nearly one-third of the total for the year.

Rents fell and vacancy rose in Q4 (Source: Cushman & Wakefield)

Shanghai racked up 74 transactions totalling RMB 83.6 billion in 2022, down from RMB 108.3 billion in the previous year, as COVID restrictions and economic uncertainty disrupted deal-making in the second and third quarters. Office assets accounted for 64.3 percent of total transaction volume in 2022, with rental housing assets ranking second in terms of asset popularity, and institutional investors were behind 40 percent of all transaction volume.

Both brokerages take a sunny view of Shanghai’s ability to shake off the challenges of the past year. “Ahead, given the relaxation of COVID-19 control measures, the general economy is expected to recover during 2023, and Shanghai is expected to see further new office supply and a more active market in the coming year,” wrote Cushman & Wakefield.

JLL predicts that the Shanghai office market will likely recover in 2023, with momentum picking up after the second quarter. Looser fiscal and monetary policy and other official inducements, including the 16-point real estate rescue package unveiled late last year, should spur financial industry growth and grade A office demand from traditional business sectors.

Daily life and business are also expected to normalize after the ongoing COVID wave subsides, “setting the stage for a recovery in confidence and market performance later in the year,” said Anny Zhang, managing director for JLL East China and head of office leasing advisory for JLL China, in a statement.

“The investment market is being bolstered by a range of policies such as the recent resumption of financing for listed real estate companies, as well as private equity being allowed to establish private real estate investment funds,” commented Ling Sun, head of capital markets for JLL East China in the same release.

Sun added that the ending of COVID restrictions combined with the cooling of asset prices over the last few years could boost investor sentiment and activity in Shanghai in 2023.

Leave a Reply