A recent report in Beijing’s Legal Evening News, reveals that based on the number of investor immigrants and the minimum investments required to qualify for investor visa programs in various countires, no less than RMB 10 billion ($1.57 billion) has left the country through investments by wealthy Chinese individuals each year since 2009.

A recent report in Beijing’s Legal Evening News, reveals that based on the number of investor immigrants and the minimum investments required to qualify for investor visa programs in various countires, no less than RMB 10 billion ($1.57 billion) has left the country through investments by wealthy Chinese individuals each year since 2009.

Given that the report based its findings on the minimum investment amount required by the governments of the United States, Canada and Australia, the actual amount of cash expatriated is likely to have been much higher. Investor emigrants to those three countries are believed to account for 80 percent of the total number of Chinese emigres.

Most of the investor visa programs, for example do not allow funds used for home purchases to qualify as part of the investment amount used to qualify for the visa. And according to Cai Hong, a manager with emigration consulting company HHL Overseas Immigration & Education who was recently quote in the press, “Usually they (the emigres) will at least buy a house after they get residency.”

And apparently these new Australians, American and Canadians have money to spend. In one case this week in Toronto a university student from China successfully bid C$1,180,800 (C$421,800 over the asking price) for a three-bedroom 1960s era bungalow.

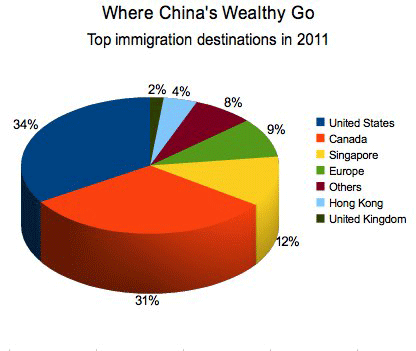

According to a joint survey by Bank of China Ltd and the Hurun Report last year, the US is the top emigration destination for these rich folks looking for a new home, followed by Canada, Singapore and Europe, The report found that 60 percent of about 960,000 Chinese with assets of more than 10 million yuan were either thinking about emigrating or taking steps to do so.

In the US a total of 2,969 Chinese people applied for the EB-5 visa program in the fiscal year 2011, accounting for three-fourths of total applicants, according to figures released by the United States Citizenship and Immigration Services. Although many are still awaiting a decision, 934 permanent residencies have been granted.

Leave a Reply