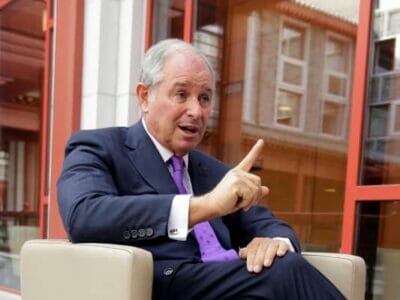

CIC has shed its stake in Stephen Schwarzman’s alternative investment giant Blackstone

Sovereign wealth fund China Investment Corporation (CIC) has exited its investment in Blackstone 11 years after taking a stake in the US alternative investment giant. During that stretch, the guardian of China’s foreign exchange reserves and the world’s biggest landlord have teamed up on at least $15 billion in real estate deals, and Blackstone continues to work with CIC as one of its asset managers.

When the Chinese government announced it was buying a $3 billion stake in Blackstone back in 2007, the watershed deal marked one of the country’s first moves to diversify the investment of its vast foreign exchange reserves, which until then were mainly ploughed into US Treasury bills, by investing in a company.

Since then, CIC has emerged as a major cross-border direct investor, snapping up tens of billions of dollars in overseas assets and growing its overall portfolio from $200 billion in 2007 to $813 billion as of year-end 2016. Alternative assets now account for over 37 percent of that total.

CIC and Blackstone to Remain Close

Blackstone announced in a recent filing that Beijing Wonderful Investments, the vehicle CIC set up to invest in the New York-based firm, no longer owned any units in the company as of February 16. CIC’s initial purchase of non-voting units in Blackstone in May 2007 gave it a 9.4 percent stake in the private equity firm just before its $4 billion IPO.

CIC’s stake in NYSE-listed Blackstone has fluctuated over the years, rising to 12.5 percent in 2008 and shrinking to 4.5 percent by the end of last year, according to an unnamed source cited by Reuters. Blackstone shares now trade at about 11 percent higher than their IPO price, but the return on CIC’s investment is unclear.

Blackstone bought back a 10 percent stake in the 13.6 million square metre Logicor portfolio from CIC

“We greatly value our partnership with CIC and are grateful for their successful, long term investment in our firm,” a Blackstone spokesman commented to the Financial Times. “We continue to expand this important relationship as one of CIC’s major asset managers and look forward to working closely together.”

Some media reports have attempted to link CIC’s move to the recent escalation of trade tensions between China and the US following the inauguration of President Trump just over a year ago. Blackstone chairman Stephen Schwarzman has acted as an informal economic adviser to Trump, whose administration has threatened trade barriers and blocked major Chinese acquisitions of US firms.

However, the sovereign wealth fund has been winding down its stake in Blackstone for the past 18 months. The Financial Times quoted a senior executive at CIC as saying that the stake was “offloaded very gradually and mostly before Trump.”

Private Equity Behemoth Sells to China

Blackstone, one of the world’s largest investment firms with $434 billion in assets under management — including more than $115 billion of real estate assets — has become a serial seller of properties to Chinese investors, with CIC foremost among them. The company offloaded the west London office project Chiswick Park to CIC for £780 million ($1.28 billion) in a deal completed in January 2014.

Last June, Blackstone sold its European logistics platform Logicor to the mainland fund for $13.8 billion, marking one of the biggest property deals of all time. Blackstone bought back a 10 percent stake in the 17-country warehouse horde in December.

Despite shedding its stake in Blackstone, CIC still has investments in the company’s funds, according to a source cited by Reuters.

Leave a Reply