Regus at Grand Century Place (Source: IWG)

Flexible office giant IWG is adding four new centres in Hong Kong after taking over the last location in the city of a one-time Chinese rival to WeWork and launching three new locations on Hong Kong Island.

IWG last month opened a new centre under its flagship Regus brand in Grand Century Place Tower 1 in Kowloon, occupying a 21,191 square foot (1,970 square metre) location formerly leased by Ucommune, Jonathan Wright, Knight Frank senior director for office strategy and solutions in the city told Mingtiandi on Tuesday.

On 1 August, the firm is set to officially open a 22,175 square foot location under its HQ co-working brand in K11 Atelier King’s Road in North Point, with that debut coming shortly after it launched a new centre under the same marque in Causeway Bay’s Leighton Centre last month.

“Our expansion comes as both businesses and employees embrace flexible work solutions and continue to seek hybrid work arrangements, reaping the benefits of hybrid working’s people-centric approach in improving productivity, lowering operating costs and reducing carbon footprint from shorter commutes,” Paul MacAndrew, country manager for IWG in Hong Kong, said in an exchange with Mingtiandi on Wednesday.

Partnerships on the Rise

Located at 193 Prince Edward Road in Mong Kok, Regus at Grand Century Place offers private offices, hot desks, meeting rooms and board rooms with rates starting at HK$3,250 per person per month for private offices based on the company website at the time of publication.

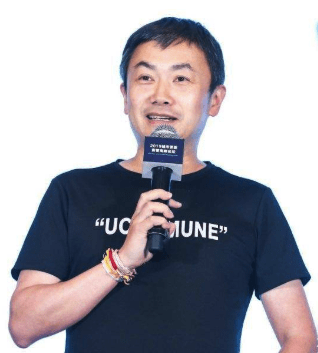

Mao Daqing, founder and chairman of Ucommune

Taking over Ucommune’s last location comes after the Beijing-based coworking provider said in its 2022 financials that it had still not achieved profitability since its inception in April 2015. Ucommune came close to being delisted from the NASDAQ exchange early last year after its share price fell below the required minimum bid price.

Ucommune, which entered Hong Kong in 2018, did not comment on its reported exit from the city, while its rival IWG continues to expand its presence in the financial hub.

Wright said IWG’s upcoming HQ at K11 Atelier is a partnership between the flexible workspace specialist and property giant New World Development, which completed the tower in 2019. The tie-up targets smaller occupiers looking to secure a spot in the 22-storey grade A office tower while also providing amenities to existing tenants in the building.

MacAndrew said his team will continue to focus on forging partnerships with office landlords in the city to “turn empty building space into income-generating flexible workspace.”

IWG’s newly opened HQ centre in the Leighton Centre tower near Causeway Bay MTR station provides up to 15,000 square feet of workspace, meeting rooms, event space, coworking space and two outside balcony areas, the company said.

Another 8,200 square feet of flexible workspace was made available last month in the China Huarong Tower at 60 Gloucester Road in Wan Chai under IWG’s self-service brand, Open Office.

Paul MacAndrew of IWG

The four new centres will boost IWG’s presence in Hong Kong to 21 locations for a total of 37 centres across the Greater Bay Area. Globally, the firm has over 3,500 locations in 120 countries.

“Flexible workspace operators are noting increased activity in the market as small occupiers continue to look for opportunities in better buildings where they can take space without deploying capital – meaning many operators have healthy occupancy rates,” said Wright, who brokered the deals at Grand Century Place and K11 Atelier.

Office Market Slumps

Landlords have been exploring ways to add value to their office buildings by offering tenants more amenities including flexible office centres, managed suites, tenant lounges, food outlets and wellness hubs, Wright said.

“The overall market remains a little slow. However, we are anticipating more activity from larger occupiers in the second half of the year and into 2024,” he added.

Hong Kong’s office leasing market continued to slide in the second quarter as the border reopening in February failed to stop multinational firms from downsizing in Asia’s most expensive office market.

Occupiers of grade A offices gave back 172,700 square feet more than they booked last quarter, especially in Tsim Sha Tsui and Central, as firms scaled back their operations. The negative net absorption pushed overall vacancy from 17.1 percent at the end of March to 17.3 percent by 30 June.

Less leasing means grade A office rents have slid 3.6 percent so far this year, with the Hong Kong East area around Quarry Bay and North Point leading the drop with a 6.4 percent decline.

Leave a Reply