Singapore, Hong Kong and Japan among the top five sources of cross border global capital: Colliers

In our latest report Global Capital Markets: Insights and Outlook – Global Capital Flows, Singapore tops the list of biggest global spenders so far in 2023 followed by the US. The Lion City, with cross border capital investments of US$21.84 billion in the first half of 2023, now represents around a quarter of the total investments and is three times bigger as a spender this year than Canada in the third position. Hong Kong and Japan stood out as the fourth and fifth largest source of cross-border capital, spending US$6.51 billion and US$5.15 billion respectively in the first six months of the year.

The region came out equally strong as an investment destination. Japan, China, Australia and Singapore are among the top 10 investment destinations globally with healthy investment growth seen across each of these markets. Click on the interactive map to see the Top 10 H1 2023 Global Capital Sources and Destinations.

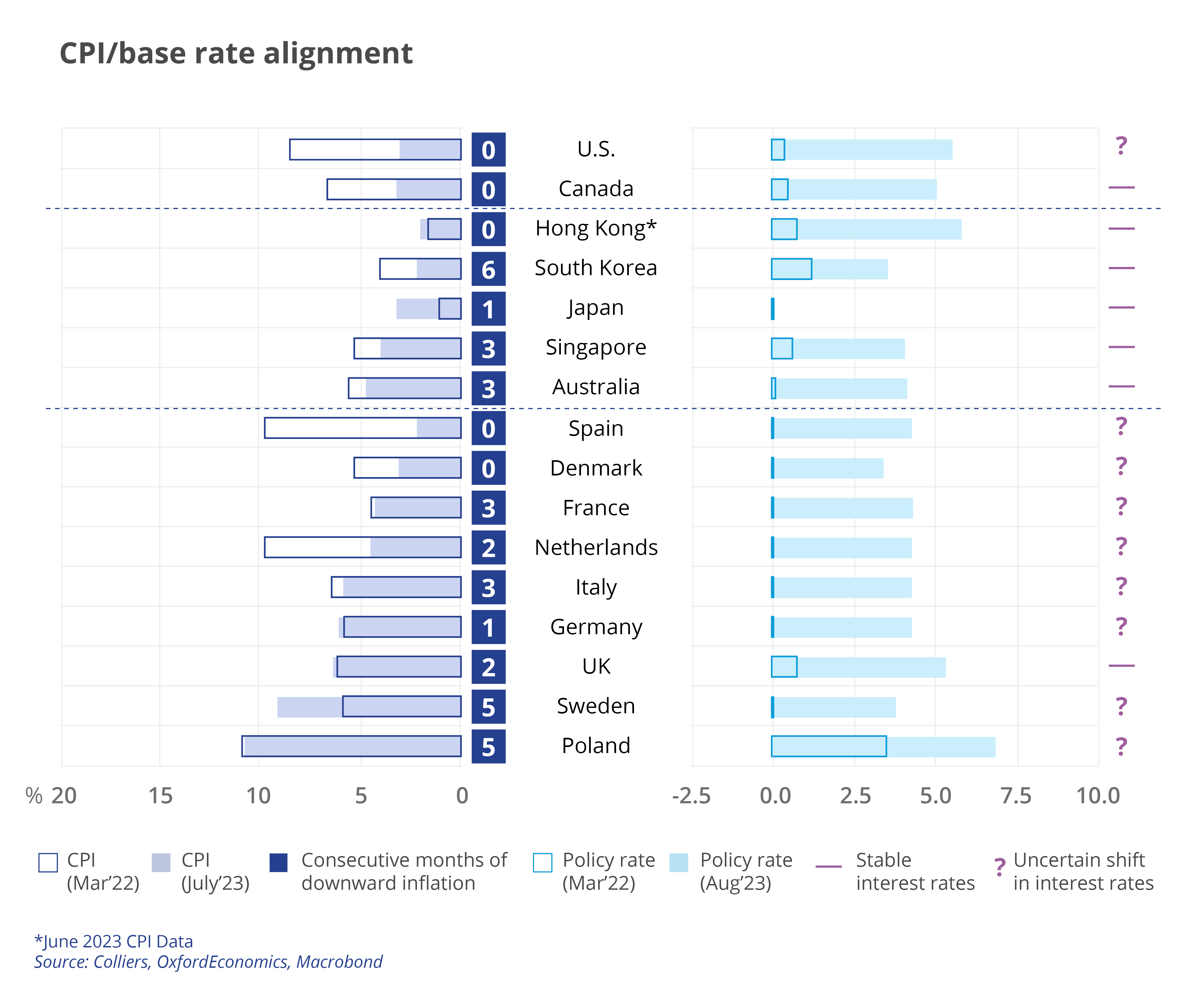

Asia Pacific | Inflation & interest rate outlook

APAC is the most diverse market in terms of factors at play, with rates in Japan holding at 0.1 percent for many years. Inflation in other key regions remains manageable, and all markets have CPI at below 5 percent, suggesting future rate rises are no longer necessary. In Australia, rates have been on hold as inflation has been wound back from April 2023 highs, with clearer signals that rates are at their peak.

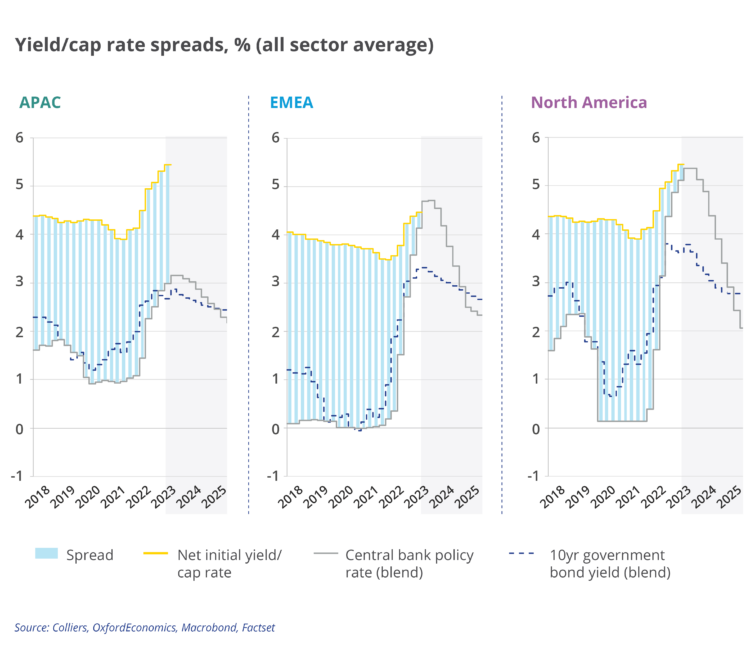

Asia Pacific | Most diverse range of markets and by far the biggest spread range

While spreads are wholly positive, this is driven by markets such as Japan and Singapore where yields are trading at a widespread. Australian all-sector spreads are also positive (75 basis points). Growing consensus that rates may have peaked is feeding into more positive investment sentiment in the market.

Download the Report here: Asia Pacific a dominant source of global capital | Colliers

Leave a Reply