Serene Centre houses shops on the first two floors and apartments on the third and fourth floors.

Apricot Capital, the family office of Singapore instant coffee king David Teo and his family, is buying a mixed-residential and retail property in Bukit Timah for S$105 million ($77 million) as the city-state’s real estate market continues to appeal to rich families seeking to preserve their wealth.

Apricot has signed a sale and purchase agreement to acquire the four-storey Serene Centre retail and residential complex at the corner of Bukit Timah and Farrer Road from Chee Tat Holdings, a private firm controlled by a local family surnamed Ng, according to market sources on Tuesday who confirmed an earlier Business Times account.

With all 30 retail units and 10 apartments in the district 10 complex fully leased, Mingtiandi understands that Apricot intends to hold the asset as a source of rental income, although it may also consider future opportunities to enhance the 1980-vintage property to help boost returns.

Apricot’s acquisition follows its last publicly known major purchase two years ago when it teamed up with Lian Beng Group and 32RE in May 2021 to acquire Breadtalk’s headquarters near Paya Lebar for S$118 million.

Instant Returns

Serene Centre spans 47,475 square feet (4,410 square metres) in gross floor area with shops and restaurants on the first two storeys and residences on the third and fourth floors.

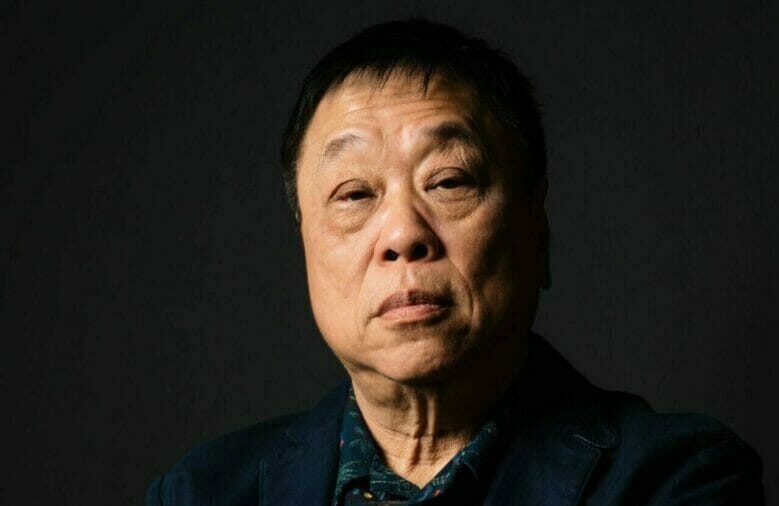

Apricot Capital boss David Teo is upping his real estate holdings in Singapore (Source: Apricot)

At the price indicated, Apricot is acquiring the property at a 12.5 percent discount from the seller’s asking price of S$120 million when the asset first hit the market in September of last year.

At that time, Shaun Poh, executive director of capital markets at Cushman & Wakefield, who represented the seller in marketing the asset, pointed to opportunities to convert the apartments into serviced residences, or potentially redevelop the four-decade-old building and sell units on a strata basis.

Located at 10 Jalan Serene, Serene Centre is a short walk from the Singapore Botanic Gardens, and the Botanic Gardens MRT Interchange which serves the popular tourist destination.

After holding the Serene Centre for around 30 years, the Ng family is letting go of the asset as they trim their real estate holdings. Poh and Cushman & Wakefield declined to comment on the sale of the property.

Expanding Property Portfolio

After building up the Super Group company based on a successful 3-in-1 coffee mix brand and sales of other instant food products, the Teo family cashed out of the business in 2017 through a S$1.45 billion buyout deal with Dutch coffee conglomerate Jacob Douwe Egberts.

Shortly thereafter the clan set up Apricot as their family office to diversify into other sectors, including property development and investment, fund management, offshore marine, education, and lifestyle industries.

Sought for comment, Apricot did not respond to media queries on Tuesday. The acquisition is understood to be closing this year.

In addition to the Serene Centre, Apricot Capital’s website shows a portfolio of seven commercial assets in Singapore, as well as six more properties in Japan, Malaysia and Europe.

In 2020, the firm joined hands with Law Kar Po’s Park Hotel Group to buy the 114-room Park Hotel Kyoto in Japan from Angelo Gordon and Mizuho Real Estate Management.

The company has also teamed up with Singapore-listed Oxley Holdngs, KSH Holdings and SLB Development to develop the Riverfront Residences project in northeastern Singapore’s Hougang area, which will yield 1,472 new homes when completed in December 2024.

The Apricot Capital investment aligns with Singapore’s real estate’s positioning as a wealth preservation haven for the ultra-rich.

“Singapore emerged from the COVID-19 pandemic with its safe-haven status enhanced,” Leonard Tay, head of research for Knight Frank’s in Singapore said in a recent report. “Known for its stability even in the midst of global uncertainty, Singapore is unique as a global wealth management and financial hub that is characterised by political stability and a pro-business government.”

Leave a Reply